By Margaret Heidenry

May 16, 2024

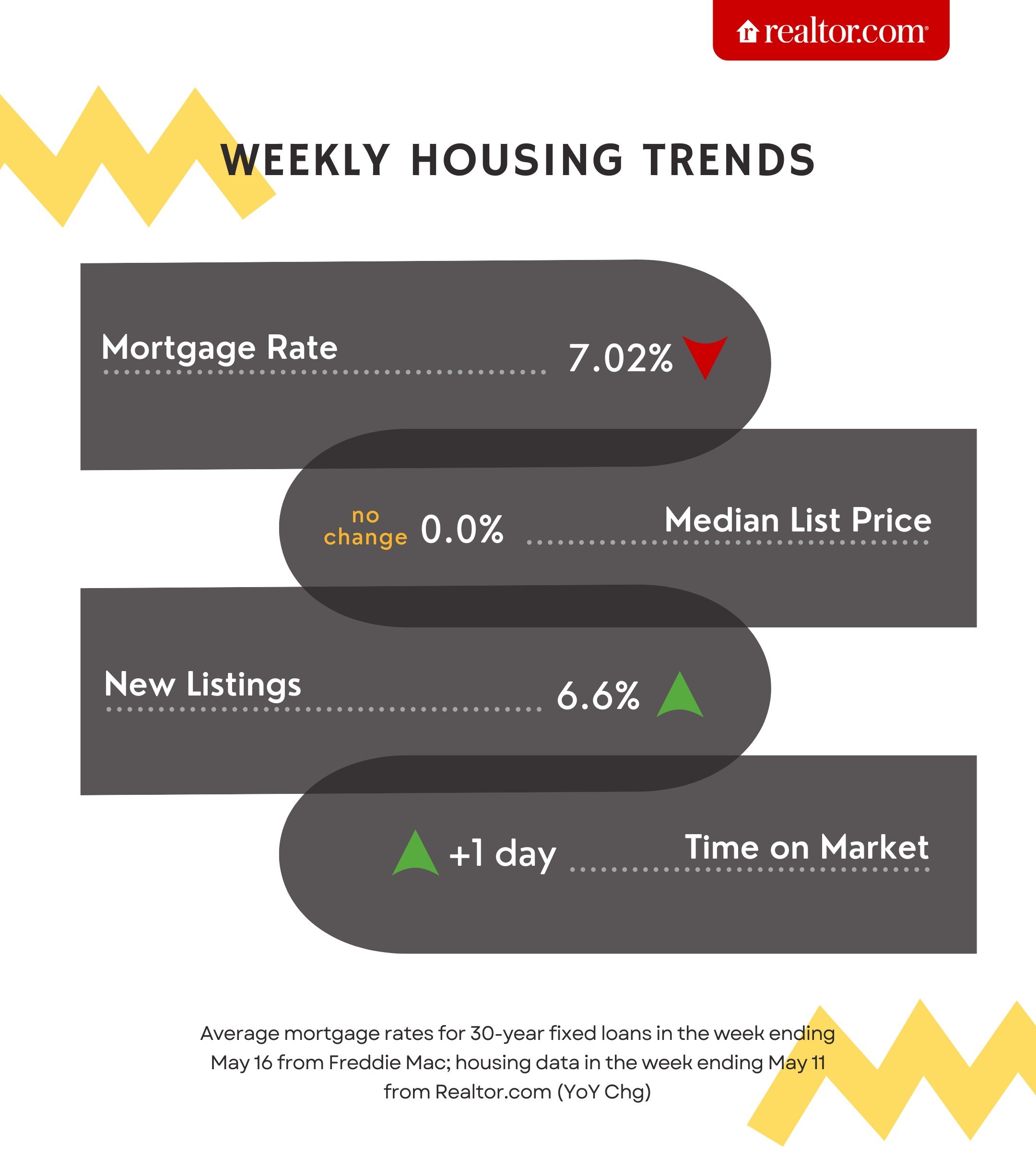

Mortgage rates continued their downward trend with the average rate for a 30-year fixed home loan dropping from 7.09% last week to 7.02% for the week ending May 16, according to Freddie Mac.

“Mortgage rates decreased for the second consecutive week,” Sam Khater, Freddie Mac’s chief economist, said in a statement. “Given the news that inflation eased slightly, the 10-year Treasury yield dipped, leading to lower mortgage rates. The decrease in rates, albeit small, may provide a bit more wiggle room in the budgets of prospective homebuyers.”

Mortgage rates have been on a repetitive see-saw lately, bouncing between the mid-6% range and to over 7%, so whether this week’s movement will make a difference in the sluggish spring housing market remains to be seen.

“Mortgage rates remain stubbornly close to 7%,” says Realtor.com® economist Jiayi Xu. “To see mortgage rates dip further below 7%, persistent evidence showing inflation back on the path to 2% will be necessary.”

Until then, buyers might want to focus instead on the housing market breakthrough that’s been four years in the making.

“Last week saw the highest number of homes for sale since August 2020, a significant milestone,” says Realtor.com senior economic research analyst Hannah Jones in her latest analysis. “The recent strength in listing activity means buyers are seeing more homes for sale than they have seen in almost four years.”

Will a rush of homes hitting the listing pages tempt both buyers and sellers to accept high mortgage rates and dive in? Here’s what the latest real estate data means for homebuyers and sellers in our most recent installment of “How’s the Housing Market This Week?”

The latest mortgage rate outlook

Despite this week’s dip, mortgage rates have remained stubbornly high, largely powered by the robust economy.

Though the Federal Reserve had promised to lower key interest rates in 2024, it has yet to do so as economic reports have been coming in strong. (Though the Fed does not set mortgage rates, the two numbers often move in the same direction.) Yet this week, a report showed that inflation fell from 3.5% in March to 3.4% in April.

“This week’s consumer price index inflation data showed improvement, a welcomed sign of progress which can positively affect mortgage rates,” says Jones. “The CPI data will likely hold more sway over the policy and economic outlook, which means we may see this positive data reflected in mortgage rates in the near term.”

Economist Xu agrees, adding, “While this improvement is a baby step forward, it’s expected to foster stability in mortgage rates at their current level and possibly even trigger further declines.”

While many might be waiting for rates to fall before entering the housing market, some buyers have a workaround for high mortgage rates: larger down payments.

The more money a buyer puts down, the more they “minimize housing payments at a high mortgage rate by minimizing loan size,” explains Jones.

The listing pages hit a four-year high

Buyers who have faced years of scarce listing pages have much to celebrate, given the data for the week ending May 11. The total number of homes for sale was strong, 35% higher than the previous year, marking 27 weeks in a row that homes have been above the previous year’s levels.

“Seller activity continued to climb annually last week and accelerated relative to the previous week’s growth,” says Jones.

However, she notes that the annual amount of fresh listings “was lower than almost every week back to early February, signifying a slowdown in new listings growth.”

New listings were up for the week ending May 11 by 6.6% from a year ago.

“New listing activity will continue to be influenced by mortgage rate movement, but cooling labor market and inflation data could mean things are moving in the right direction,” says Jones.

Home prices remain flat

The median list price didn’t rise or fall for the week ending May 11, remaining unchanged at 0.0%.

“The prices for homes on the market notched in at the same level as one year ago for the second week in a row,” says Jones. (The median-priced home cost $430,000 in April.)

A flood of homes priced in the budget-friendly $200,000 to $350,000 range might have helped to tamp down list prices compared with last year.

The pace of home sales is slowing

The pace of the market softened for the week ending May 11, with homes lingering one extra day compared with the same time a year prior. (The typical home spent 47 days on the market in April.)

“Homes sold slightly slower than one year ago last week but remained within a tight margin of the previous year, as has been the trend over the last couple of months,” says Jones.

As to the reason why, once again, all roads lead to mortgage rates. If rates cool, the pace of home sales will likely tick up.

“Improving mortgage rates could bring buyers back en masse, which could drive up competition and lead to a quicker pace of sale,” says Jones.

However, as Jones notes, it’s also important to note that homes are still selling “faster than pre-pandemic.”

Margaret Heidenry is a writer living in Brooklyn, NY. Her work has appeared in the New York Times Magazine, Vanity Fair, and Boston Magazine.The realtor.com® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

1,199 total views, 1 views today