First-Time Home Buyer Loans in Texas: Programs and Requirements

So, you’ve decided to purchase your first home. Congratulations! Now, you likely have a lot of questions. The biggest questions out there are about first-time buyer home loans. There are many programs designed to assist first-time buyers in their home purchases, but where do you begin? What exactly is required to qualify for these first-time buyer programs? The realtors at Ann Jones Real Estate can help you sort through the loans, programs, and qualifications. Here’s an idea of what you might need to know to get started.

First-Time Home Buyer Programs in Texas

If you live in Brownwood, Texas, or the surrounding area, you need to know what programs are available in Texas. You’re in luck. There are programs for you.

Texas has basically six different FTHB (first-time home buyer) programs specific to the state. Here is a list of those programs.

- My First Texas Home

This loan is specifically for first-time home buyers. Applying for this loan is simple and some of the features include

- Low downpayment requirements of 2-5%

- 3-year forgivable second loans

- 30-year second loans at 0% interest rate

- Downpayment assistance with a mortgage credit certificate

- My Choice Texas Home

This loan is available throughout the state of Texas. Some of the features include

- No FTHB restrictions

- Assistance with down payment and closing costs

- Higher income limits than the My First Texas Home program

- Home Sweet Texas

This loan has a little different flavor. You choose a lender, and the lender has to be approved for the TSAHC DPA programs.

- Home for Texas Heroes

This loan is for teachers, firefighters, police officers, veterans, corrections officers, EMS, and nurses.

- Texas Bootstrap Loans

This loan is designed to assist Texans with building their own homes. Some features include

- 0% fixed rate 30-year loan (limited to $45000)

- Works best for people who are interested in doing their own building

- Texas Mortgage Credit Certificate

This is a tax credit program. It allows Texans to receive credit toward their mortgage payments up to $2000/year.

Requirements for First-Time Home Buyers in Texas

For the My First Texas Home Loan, the home buyers must be first-time homebuyers or not have owned a home in the past three years. You must also have a credit score of 620 minimum and meet the income requirement. The property value must also meet the requirements of the program and you’ll need to work with an approved mortgage lender.

The qualifications for the My Choice Texas Home Loan also include a credit score of at least 620, you must meet income limits, your home must meet the loan requirements and you must work with an approved lender.

In order to qualify for the Home Sweet Texas Loan, you must meet the following criteria. A FICO score of 620 for VA, FHA, or USDA or a credit score of 640 for a conventional loan is required for this loan. Approval from an approved lender and income limits are also required. In addition, this loan requires the completion of a homebuyer education course by one or both of the borrowers.

The Home for Texas Heroes is a wonderful program that basically just requires the borrower to have one of the qualifying professions to be approved for the loan.

The Texas Bootstrap Loan is a great loan for those who wish to do much of the work on their property, with that really being the one major requirement. The home buyer must be doing at least 65% of the work and must fall below 60% of the median income level.

The qualifications for the Texas Mortgage Credit Certificate include being a first-time home buyer or showing proof of not having owned a home in the past three years.

Nationwide First-Time Home Buyer Loans

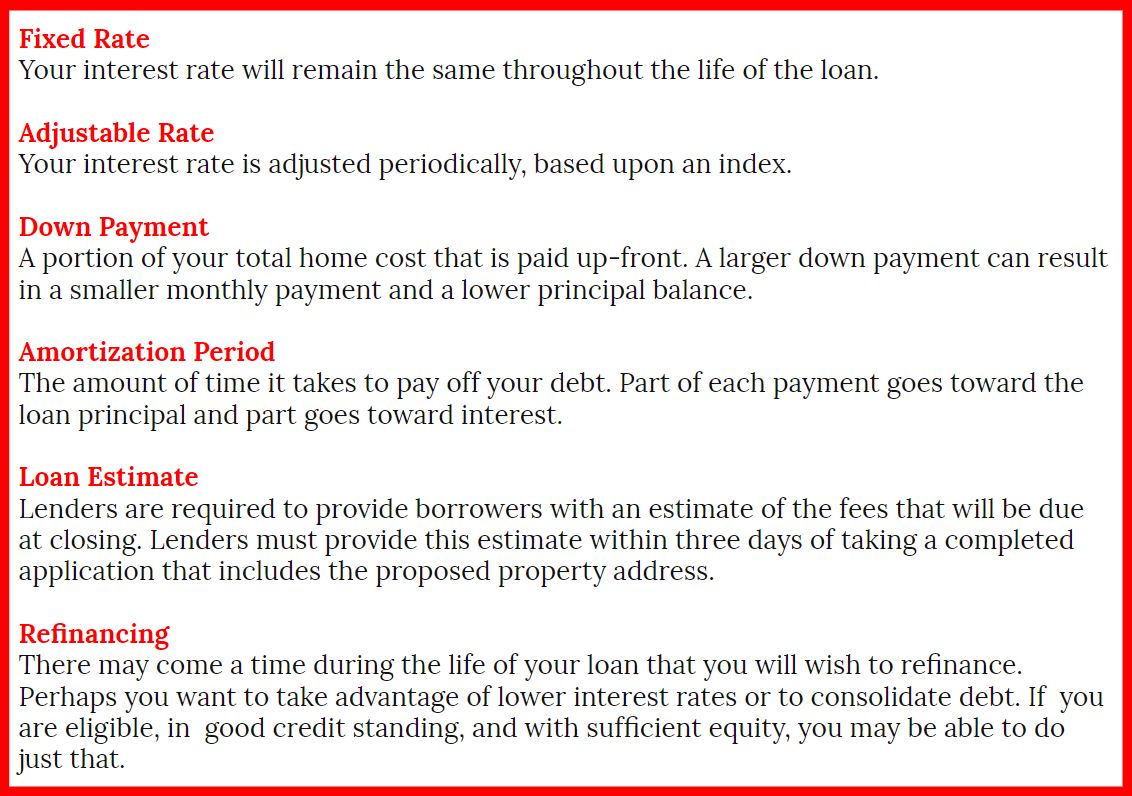

The three types of nationwide first-time home buyer loans and their features and requirements are

- VA loans-must be members of the military or their family members. These loans are for the full value of the home and require no downpayment. However, there is usually a fee that can be substantial depending on the size of the loan

- FHA loans require a credit score of 580 or higher, this loan is provided through the federal government and requires only a down payment of 3.5%. This kind of loan is ideal for those who don’t have much of a down payment.

- USDA loans-this unique loan is designed to help home buyers moving to rural areas. The income level of applicants cannot exceed 115% of the median income of the area, but if you qualify, it covers 100% of the home loan, meaning no downpayment is required.

Conclusion and CTA

With so many first-time home buyer loan options in Texas, there’s no time like the present to apply and begin looking for that first home. If you aren’t in Texas, there are many options on the national level that the federal government offers. If you have saved for a downpayment that is a wonderful benefit, but there are still many zero downpayment options available.

Ann Jones Realty

The best option when looking for that perfect first-time home buyer benefit is to contact someone who can help you navigate your options. If you are in the Brownwood, Texas area and looking to buy, sell, or rent look to the team at Ann Jones Real Estate. We are ready to assist you in all your realty needs. Helping with locating a property, creating a friendly environment, finding financing options, or selling, Ann Jones and her team are willing to help. They believe that the clients are their purpose and therefore they deserve quality service. If you are interested in learning more, visit the website or contact Ann Jones Real Estate at (325) 646-1500.

509 total views, no views today