Hello Again!

Today we’ll be discussing mortgages and the lingo that comes with them. Choosing a mortgage is one of the most significant financial decisions that the average person will make, so it’s important to understand which one will work best for you. We’ve done our best to simplify and summarize the most common types of loans.

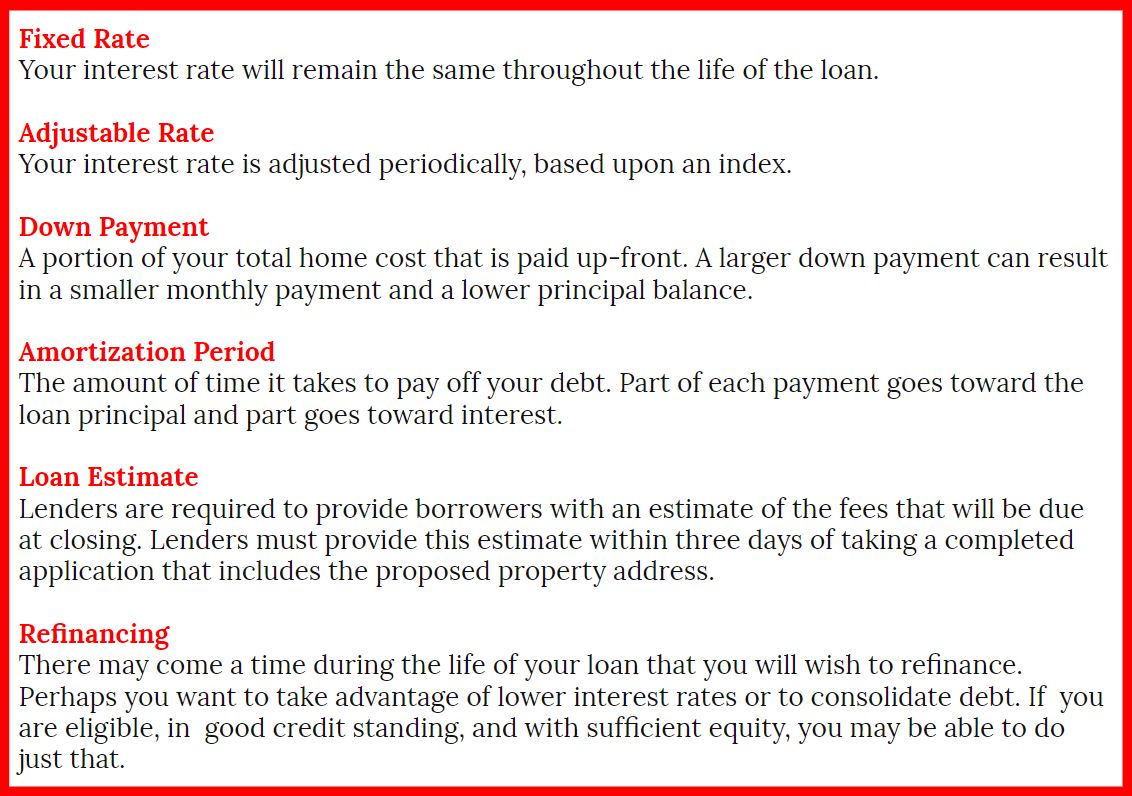

Before we get into the loans, take a peek at this Glossary to help clear up some of the jargon:

Hopefully, those definitions help as we move into finding the best loan for your circumstances.

Conventional Loan: Good for Buyers with Average and Above Credit.

Quick Overview: Requires 620+ credit score and larger down payment.

A conventional loan is a straight agreement between a bank and a buyer, and so is not backed by the federal government. It is the most commonly used and typically has the best interest rates. This type of home loan works well for buyers with strong credit and who can afford the larger down payment.

FHA Mortgage: Good for First-Time Home Buyers.

Quick Overview: Backed by the government, requires 600+ credit score and smaller down payment.

An FHA (Federal Housing Administration) loan is common for buyers who cannot afford a higher down-payment, as the required down payment is only 3.5%. This loan is backed by the federal government and does not require as high of a credit score as a conventional loan. The downside to this loan is the slightly higher interest rates. This loan is great for first-time home buyers, but is available to anyone.

VA Loan: Good for Buyers who are serving or have served in the Armed Forces.

Quick Overview: Requires 620+ credit score, and is one of few 0% down options.

The Veteran’s Administration Loan is, as the name implies, specifically for eligible veterans and their families. The federal government guarantees these loans, which means the VA will reimburse the lender for any losses if the borrower defaults. The ability to receive 100% financing for the purchase of a home is a huge advantage for qualifying buyers.

USDA Rural Housing Loan: Good for buyers with average credit and a moderate income.

Quick Overview: Requires 640+ credit score, is one of few 0% down options, but requires the property be rural according to the Department of Agriculture.

The U.S. Department of Agriculture created this loan to encourage buyers to purchase in specific rural areas. According to the USDA map feature that verifies addresses, much of Brown County and the surrounding area qualifies. You’ll need a moderate income to qualify for this loan, which the USDA defines as $82,700 for a 1-4 person household (page 276) in Brown County.

203K Rehabilitation Loan: Good for buyers looking to renovate.

Quick Overview: Requires 600+ credit score and needed repairs $5000 and up.

The “Rehab“ loan allows buyers to buy a home that needs fixing-up costing $5,000 or more. With this loan, you can pay for the cost of the home and any improvements. You need to start any repairs within 30 days and complete them within 6 months. Your lender will pay for the repairs regularly as the work is completed. Buyers who don’t mind putting in a little extra work on their new home will find this loan very helpful.

Adjustable Rate Mortgage: We do not recommend this loan!

Quick Overview: Similar to Conventional Loan, but the rate varies according to the market.

The most risky of the average buyer’s options is the Adjustable Rate Mortgage, also known as a Floating Mortgage or ARM. It starts with an interest rate that is lower than average, but after a few years the rate can change dramatically – usually for the worse. While the initial rate may seem inciting, it is all too temporary, and not a risk we recommend buyers take.

Have questions about mortgages or loan lingo? Comment below and we’ll find the answers you need!

In a hurry or just don’t feel like reading? Watch this video for a overview of Mortgage Options:

4,970 total views, 2 views today